Australia

More than 90 per cent of Australian CEOs say a sense of corporate purpose is increasingly shaping their capital spending and driving financial performance amid growing pressure from investors, regulators and their own staff to prioritise environmental, social and corporate governance concerns.

“ESG and corporate purpose have risen to the top of the CEO agenda, and climate change is top of mind ... but it’s hard to keep ahead of.”*102

There is a $680 billion opportunity for Australian businesses with the foresight to commercialise innovative tech solutions to the climate emergency.*109

The number of major companies to put in place a target of reaching net zero greenhouse gas emissions has more than trebled in the past year as corporates fight to retain access to capital and demonstrate they are environmentally sustainable.

A survey by the Australian Council of Superannuation Investors found that the number of ASX200 companies with net zero emissions targets surged to 49 in the year to March 2021, up from 14 in the 12 months to March 2020.

The predominance of the biggest companies, such as Commonwealth Bank, ANZ, National Australia Bank, Rio Tinto and BHP, in the list means more than $1 trillion of shareholder capital – more than half of the market capitalisation of the ASX200 – is covered by net zero commitments.

“The number of companies that have net zero commitments is pretty significant. It’s a lot of money moving in that direction,” ACSI chief executive Louise Davidson said.*140

The Emissions Reduction Fund awards credits to entities that cut their pollution by employing one of the approved techniques and Energy and Emissions Reduction Minister Angus Taylor announced on Friday carbon capture had been added to the list.

Techniques already approved include soil carbon sequestration, avoided land clearing, emissions capture from landfill, improvement to heavy transport efficiency, and fugitive gas capture in mining. Carbon credits are either bought back by the government or sold to industrial polluters who want to offset their greenhouse emissions.*141

The issue Australia now faces is that the area in which it lags, climate, threatens to undermine those it outperforms in.

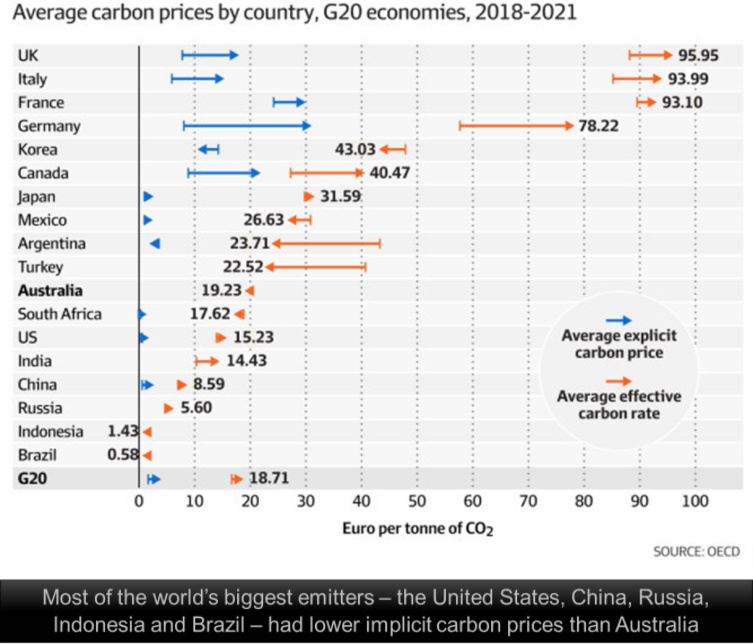

Last month, Treasurer Josh Frydenberg warned that the cost of capital will increase – impacting interest rates on home loans, small business loans, and the financial viability of large-scale infrastructure projects – if Australia’s global reputation as a laggard on climate reform does not improve.

“We cannot run the risk that markets falsely assume we are not transitioning in line with the rest of the world. Were we to find ourselves in that position, it would increase the cost of capital and reduce its availability, be it debt or equity,” Frydenberg said.

The Treasurer wasn’t exaggerating when he said Australia has a lot at stake. The nation’s current stock of foreign investment stands at $4 trillion. Roughly 20 per cent of wholesale funding of its banking system is sourced offshore, while close to half of all Commonwealth government bonds are held by foreign investors.

In a nutshell, imported capital keeps the economy humming.

With considerations around climate risks now being hard-wired into how global financial institutions allocate capital – at both a firm and country level – trillions of dollars are being mobilised in support of the transition, away from so-called toxic assets and towards clean energy investments*142

What Frydenberg finally admitted, boards and executives have been dealing with for the past 18 months. In the absence of federal policy, business is leading the charge on net zero, along with state and territory governments.

EY partner Adam Carrel says the private sector will be caught up in a massive shortage of carbon credits in the race to net zero. “A massive shortage is looming,” he says.

At the same time, Carrel says, Australia is missing an opportunity to accelerate the growth of a carbon credit market, and a burgeoning export market, by not sending a signal about the percentage of home-grown credits it expects organisations to buy versus cheaper international alternatives.*142

Change is never easy or cheap, but as the low carbon transition accelerates locally and internationally, it is inevitable, and the cost of inaction on climate change comes at a massive cost to the economy, business and growth.

Embracing a low carbon economy should not be viewed as a threat but as an opportunity to prepare Australia for the riches and wealth that will flow from the low carbon and sustainability revolution.

As an energy nation, Australia is uniquely poised to leverage this national endowment to create and accelerate new industries, businesses, and export opportunities.

But it requires purposeful and meaningful action now.

The scale of disruption and the associated market opportunity of decarbonisation is becoming more and more evident. Bushfires at home and abroad, coupled with drought and water scarcity, have rammed home the firsthand impacts of climate change, along with the need to adapt to avoid similar or worsening situations in future.

Adapting to change is in Australia’s DNA. Australia is a resilient and resourceful nation that has adapted and responded to the challenges of a harsh but bountiful country.

Shouting at the climate won’t make it go away. As federal Treasurer Josh Frydenberg remarked, the climate has no postcode - it is not an arcane debate between the city and the bush.

Nor does it recognise geographical boundaries or international borders.

As Frydenberg noted, private financiers and investors have already committed significant funds to back corporations able to drive and accelerate progress towards a low carbon future. Companies can achieve green growth through serving new and growing markets created by the low carbon transition.

On the flipside, financiers, insurers and investors are increasingly making choices to deny their funds to those at risk of not being able or willing to adapt to climate change. For them, it is a question of risk and future returns.*143

Australians have nominated climate change as their top environmental, social and corporate governance (ESG) priority, but have marked down governments and companies for being slow to act.

SEC Newgate managing director for research Sue Vercoe said: “The results are really clear that the community are out in front leading on ESG and looking very closely at what companies are doing and factoring it into their purchasing decisions.”

“People are really hungry for more information to allow them to make a better decision on how companies are performing.”

Australians say they are willing to pay a little more for goods and services from businesses with good ESG reputations, particularly for everyday items such as food, clothing and personal care products.*144

Top listed companies will face new pressure on climate disclosure after the launch of a new global standard setter for sustainability reporting announced at COP26 in Glasgow.

The new International Sustainability Standards Board (ISSB) will sit alongside the International Accounting Standards Board (IASB) and will elevate sustainability reporting to the same status of financial reporting.

Investors and advisers are already warning that the Australian government and regulators must “get on board” to ensure our financial markets are not left behind.

CPA Australia – which has been involved in the consultation on the design of the ISSB – warned that if the Australian government and regulators do not “get on board”, then major listed companies might find themselves adversely impacted in the global capital markets.

“If Australia doesn’t get on board, the reputation of our financial markets may be damaged, Australian companies may find their share price impacted and capital raising in international markets could become harder,” General Manager External Affairs Jane Rennie said.

The CEO of the Australian Council of Superannuation Investors Louise Davidson said investors would continue to play a critical role in holding companies to account on realistic and tangible plans to achieve their climate aspirations.*146

Nathan Fradley, of Lime Financial Planning, a certified ethical investment adviser, says the response to COP26 from clients and investors is not just a heightened interest in environmental, social and governance (ESG) issues but “frustration” at the lack of progress from governments.

“Investors feel it is another let-down that does not do enough,” Fradley says. “What is refreshing, though, is that the frustration is visible and widespread. I feel this will put further pressure on business to lead the way, with a larger focus on carbon emissions by super funds, and climate change risk as a thematic for investment.”

“It’s clear that ESG has finally moved into mainstream investment management because it is no longer possible to ignore the science of climate change, nor deny the conclusion that we are at a tipping point in terms of the global environment,” says Pierre Lenders, head of ESG at Capital Fund Management in Paris.

But while more and more investors are allocating all or some of their portfolio to ESG investment products, they also increasingly expect more from their fund managers than just screening out fossil fuel companies and pocketing a performance fee.*147

Australian companies are jumping through hoops to prove their investment worthiness in response to institutional investors scrambling to secure green bonds.

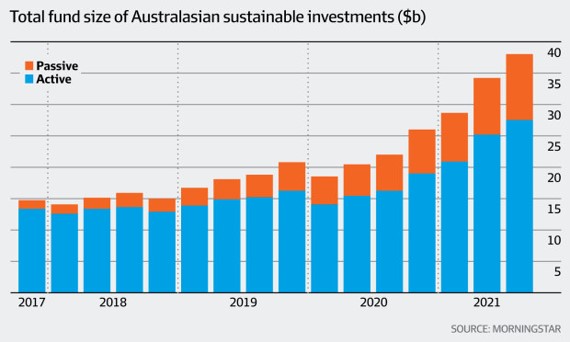

From a small base, sustainable bond issuance has boomed over the past 18 months as companies continue to tell the market that they are intent on being part of the climate change solution.

Money is flowing into green bonds, social bonds and sustainability-linked bonds as companies show the market that they’re serious about reducing their carbon footprint, says Jay Sivapalan, head of Australian fixed interest at Janus Henderson Investors.

The number of green, social and sustainability bonds issued in Australia in the first half of this year almost equalled the total for 2020.

The largest green bond issue, the first sustainability-linked bond and the most diverse set of deals for investors have manifested this year, the asset management house confirms*148

The surge in demand in Australia’s voluntary carbon markets is accelerating as companies act on decarbonisation commitments, with a record number of credits surrendered last quarter, according to the Clean Energy Regulator.

The total number of carbon credits and certificates surrendered – thereby contributing to emission reduction pledges – was up by 24 per cent year-on-year by the end of September to 2.7 million, the regulator said in its quarterly carbon market report.

By far the majority of the total were international carbon credits, which can be bought for a fraction of the price of higher-quality, domestically sourced Australian Carbon Credit Units. Large-scale renewable energy certificates are also included in the total, which could reach about one million this year, said Mark Williamson, executive general manager at the regulator.*149

Get in Touch

Sign up to our regular newsletter

"*" indicates required fields